Four of New York’s nine-member Republican congressional delegation to Washington, D.C., voted in favor of eliminating the popular state and local tax deduction that saves money for 35 percent of state taxpayers. The deduction allows them to avoid paying federal taxes on income they have already spent on local and state taxes, typically property and income taxes.

Due to the unpopularity of the measure, the vote will likely have political repercussions for lawmakers who voted for it, but also for those who oppose it – House Speaker Paul Ryan recently punished Long Island Rep. Lee Zeldin for his “no” vote by taking the proceeds from a fundraiser that was supposed to benefit Zeldin’s re-election campaign.

If lawmakers entirely repeal the state and local tax deduction, New York taxpayers who use it will pay taxes on an additional $22,169 in income on average, according to the nonpartisan and nonprofit Government Finance Officers Association.

The full repeal in the U.S. Senate plan would result in New Yorkers paying a total additional $17 billion in taxes, according to the organization’s calculations, which assume a 25 percent average marginal tax rate for all taxpayers. But estimates for a partial repeal, as laid out in the House bill or in some other form, are currently unavailable.

Here's a look at how much each taxpayer who uses the SALT deduction could lose if it's fully repealed, assuming the same 25 percent average marginal tax rate:

RELATED: How the Republican tax plan will affect New Yorkers

District 1

Rep. Lee Zeldin

Voted: No

Percentage of taxpayers who use the SALT deduction: 46%

Average amount they’d stand to lose per year: $4,421.38

District 2

Rep. Peter King

Voted: No

Percentage of taxpayers who use the SALT deduction: 48%

Average amount they’d stand to lose per year: $5,027.66

District 11

Rep. Dan Donovan

Voted: No

Percentage of taxpayers who use the SALT deduction: 36%

Average amount they’d stand to lose per year: $3,442.19

District 19

Rep. John Faso

Voted: No

Percentage of taxpayers who use the SALT deduction: 31%

Average amount they’d stand to lose per year: $3,125.25

District 21

Rep. Elise Stefanik

Voted: No

Percentage of taxpayers who use the SALT deduction: 23%

Average amount they’d stand to lose per year: $2,966.34

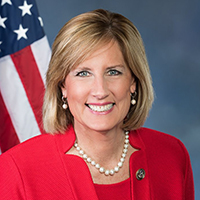

District 22

Rep. Claudia Tenney

Voted: Yes

Percentage of taxpayers who use the SALT deduction: 23%

Average amount they’d stand to lose per year: $2,691.41

District 23

Rep. Tom Reed

Voted: Yes

Percentage of taxpayers who use the SALT deduction: 22%

Average amount they’d stand to lose per year: $2,929.02

District 24

Rep. John Katko

Voted: Yes

Percentage of taxpayers who use the SALT deduction: 29%

Average amount they’d stand to lose per year: $3,035.08

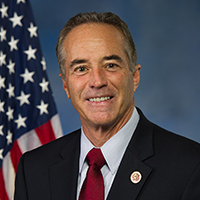

District 27

Rep. Chris Collins

Voted: Yes

Percentage of taxpayers who use the SALT deduction: 29%

Average amount they’d stand to lose per year: $3,031.33

Source: Government Finance Officers Association