When state lawmakers took up the 421-a program last year, they ultimately left it to the real estate industry and construction unions to hash out the final details – and a failure by the two groups to reach a deal led to the program’s expiration last month.

The unions, which won the backing of Gov. Andrew Cuomo, want higher wages on housing developments that get tax exemptions through the program, which is aimed at spurring the construction of affordable units. But the real estate industry argued that such a move would raise costs so high that it would hinder new construction.

Now, with developers and housing advocates alike emphasizing the need for some version of the program – especially if New York City Mayor Bill de Blasio is to carry out his ambitious affordable housing goals – it will again be up to elected officials to figure out some sort of compromise.

“The 421-a program as it existed just didn’t work,” New York City Councilman Jumaane Williams told City & State. “It was not effective in building affordable units, period. So I wasn’t the saddest to see it go. However, I firmly believe that we need something, whether you call it 123B, D582, whatever it is, there has to be something that is there.”

Here’s a rundown of a few pending 421-a proposals – from officials who were actually elected to make these kinds of decisions.

S5768

Sponsor: State Sen. Jack Martins

Status: In the Labor Committee

“This bill would extend the provisions of section 421-a of the real property tax law an additional three years and apply the prevailing wage laws on any project of this type.”

S3713

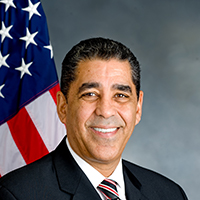

Sponsor: State Sen. Adriano Espaillat

Status: In the Housing, Construction and Community Development Committee

“This bill makes several amendments to the 421-a tax abatement program. The goals of these amendments are: to extend the program for an additional three years; adjust definitions to more accurately reflect current construction practices; provide additional incentives for the continued construction of new and affordable housing units; and correct current statutory inaccuracies. Additionally, the bill would provide a tax exemption for new multiple dwellings with three or fewer units to further incentivize the construction of new housing.”

S6628

Sponsor: State Sen. Tony Avella

Status: In the Housing, Construction and Community Development Committee

“The purpose of this bill is to change the calculation of the income eligibility criteria for new housing construction participating in the 421-a property tax benefit program so that such calculation is not distorted by income levels outside of the community in which the new construction is located.”

A9074

Sponsor: Assemblywoman Rodneyse Bichotte

Status: In the Real Property Taxation Committee

“Relates to a minority and women-owned business enterprise participation goal requirement in order to receive exemption of new multiple dwellings from local taxation.”