New York City doesn’t make it easy to calculate—let alone understand—the annual tax on a home. So here’s a quick rundown of how it’s done for Class 1 properties, or residences with one to three units.

- Estimate a property’s market value based on recent sales of comparable buildings.

- Use the assessment ratio to determine the assessed value, which is a standard 6 percent of the market value.

- Factor in the assessment cap, which limits assessment increases to 6 percent a year or 20 percent over five years. When applicable, this reduces the 6 percent assessment ratio.

- Subtract the exempt value, or any amount that is not taxable, from the assessed value to get the taxable value.

- Multiply the taxable value by the tax rate, which is 19.157 percent this year, to determine the annual property tax.

- Subtract any abatements, credits or refunds.

- To determine the effective tax rate, divide the market value by the property tax.

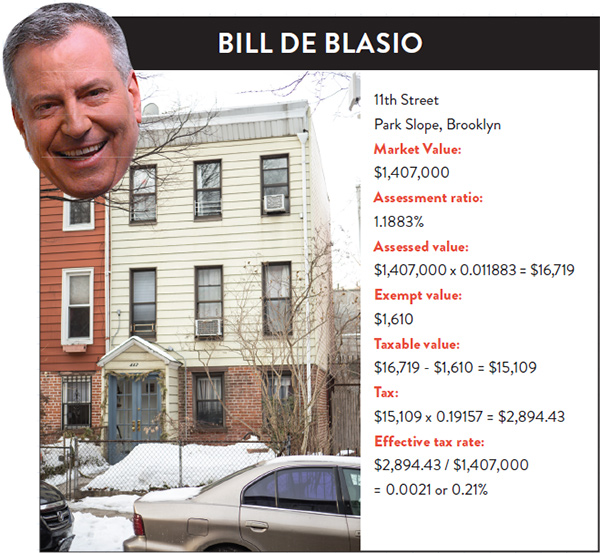

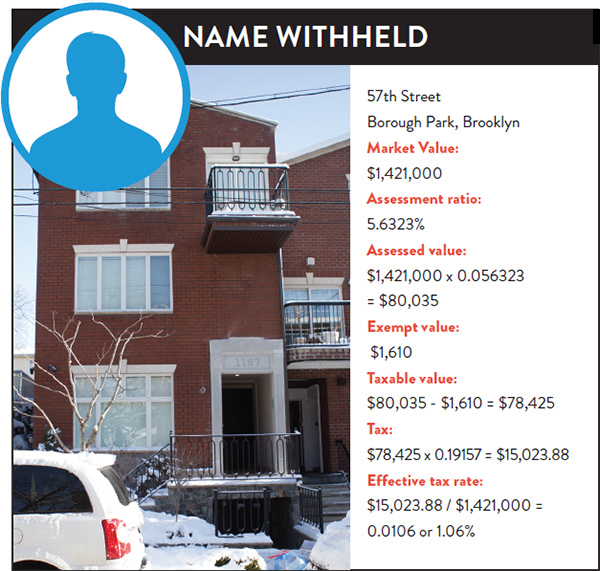

Got that? Let’s take a closer look at two properties with similar market values but very different tax bills.

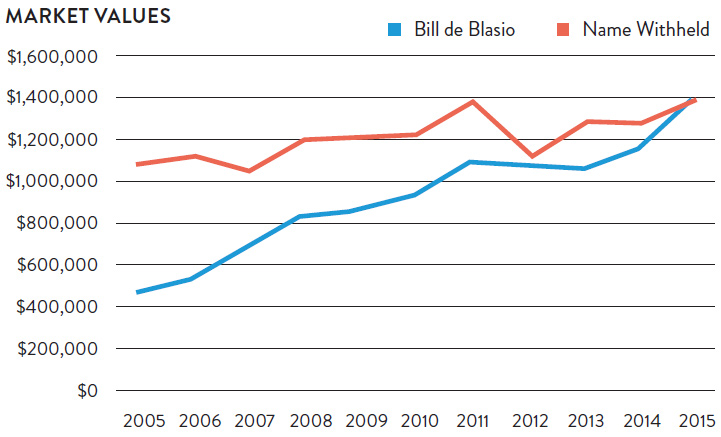

The key factor behind the inconsistent tax bills is the rate at which a property value goes up. For rapidly appreciating properties such as the mayor’s, the assessment cap means that the tax can’t keep up with the market value.

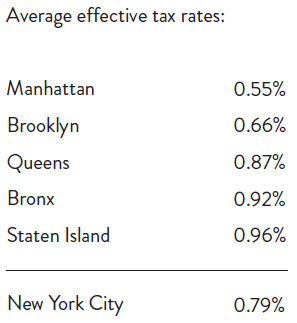

As a result, the effective tax rate of 0.21 percent for the mayor’s Park Slope property is well below the borough-wide average of 0.66 percent, while the 1.06 percent rate for the Borough Park residence is far higher. How do they compare to the rest of the city?