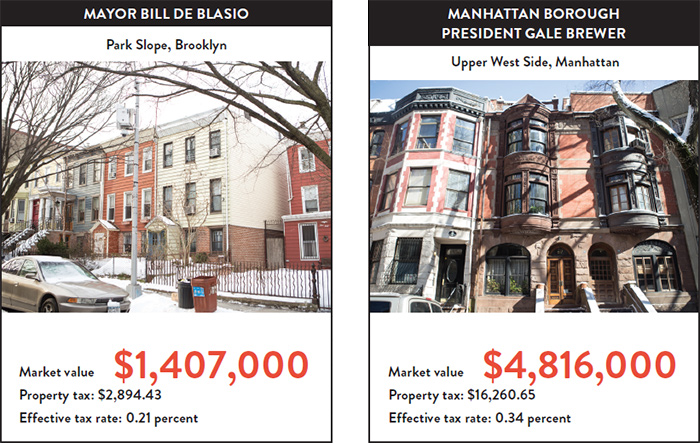

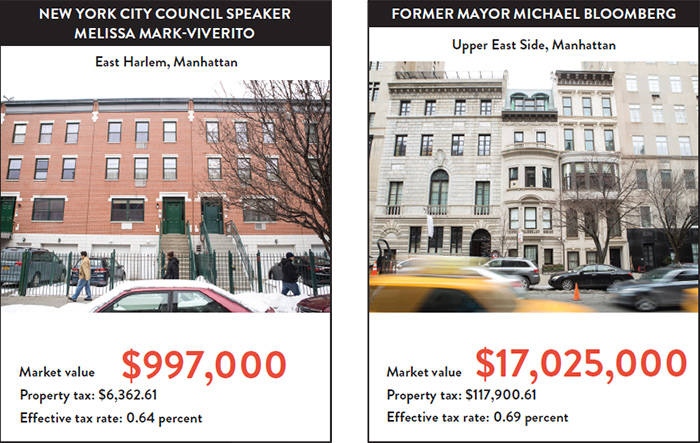

Just like other homeowners in New York City, elected officials who own residential property pay a wide range of tax rates. As a baseline, the average effective property tax rate for Class 1 properties—residential units with one to three units—is 0.79 percent in the city.

Nonprofits Case Studies

Powered By

Browse The Atlas full case study database or read more case studies about

Nonprofits.

NEXT STORY: Class Divisions